At Northern Arc, we are committed to actively enhancing our retail portfolio through collaborative partnerships with NBFCs and lending platforms.

We commenced our partnership-based Direct-to-Customer Lending business through our Retail Lending Partners, in fiscal 2015. We were also one of the first NBFCs to implement a partnership-based retail lending model in India (source: CRISIL Report). We offer a comprehensive range of loans, both secured and unsecured, through our Retail Lending Partners across:

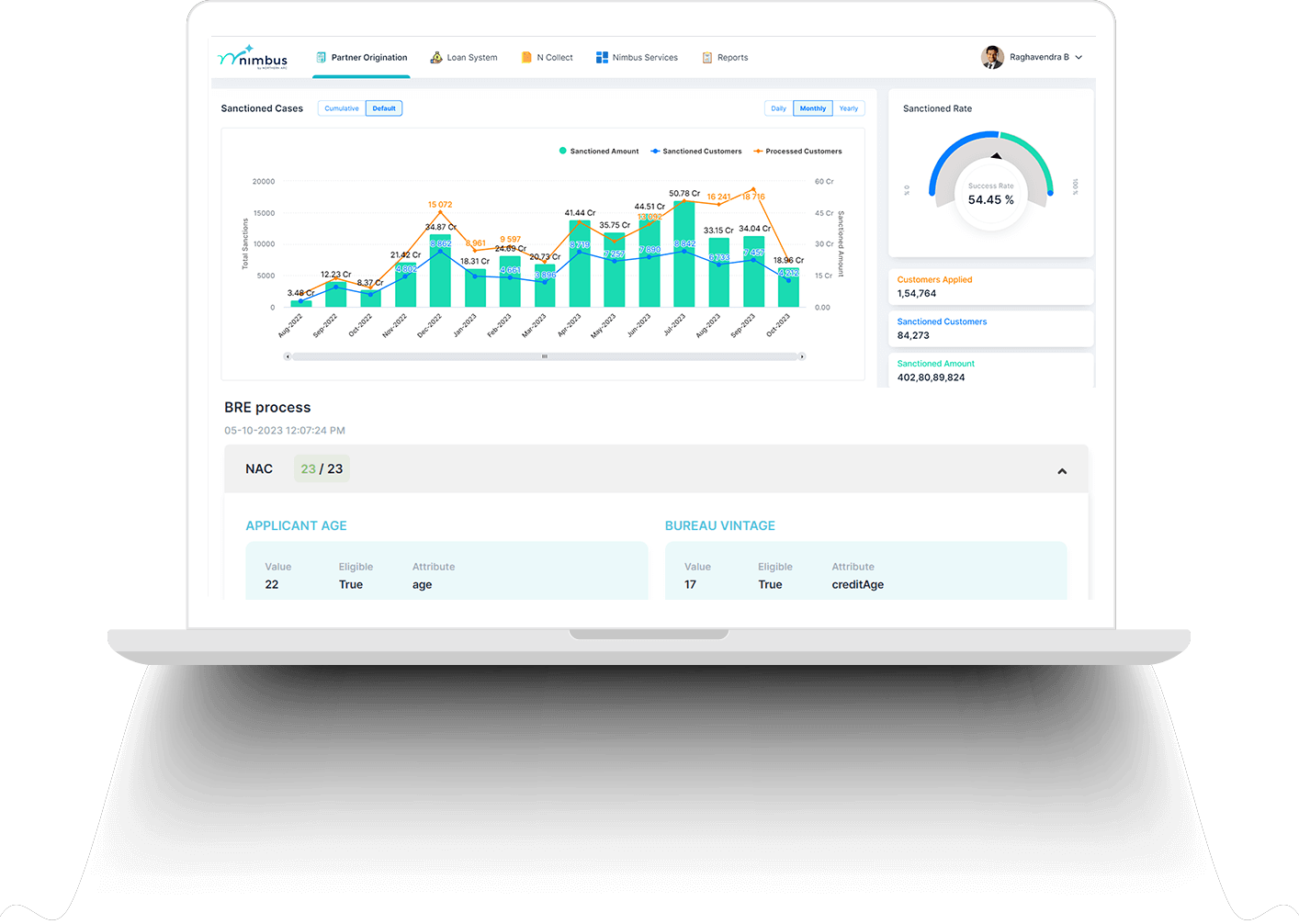

Our Retail Lending Partners work with us as co-lenders and/or loan service providers. Our partners encompass a diverse range of entities, including NBFCs, digital lending firms, payment FinTechs, business correspondents, merchants, and educational/vocational institutes. Through nPOS, our Retail Lending Partners can seamlessly integrate across multiple business processes throughout the lifecycle of loans, enabling them to offer services such as sourcing, underwriting support, disbursements, collections, and customer servicing.

We design each of our partnership-based lending arrangements to ensure that we have sufficient controls on the customer segment, credit policy, risk reward mechanism, underwriting, customer communications, cross-sell facilitation, and funds flow.

The digital collection of data in standardized formats across asset classes from Retail Lending Partners and integration with various databases helps us in quick decision making through a combination of machine learning-based proprietary algorithms and business rule engines. Our analytical models, reinforced by such machine-learning-driven proprietary scorecards, continuously evolve and adapt as we process more loans and accumulate performance data.

The risk reward mechanism is a combination of default loss guarantee (DLG) and risk-based pricing, which aims to ensure that incentives are aligned with the Retail Lending Partners.