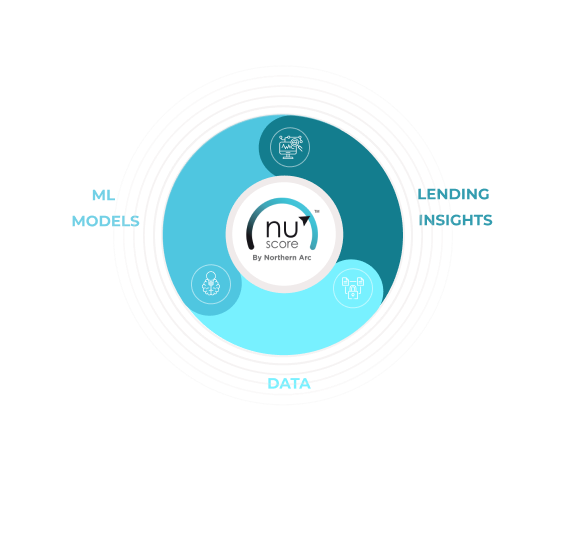

NuScore is an enterprise-grade Analytics-as-a-Service based solution for financial institutions. We use advanced analytics and machine learning to create intelligent scorecards and deliver deep insights— helping you make faster, data-driven decisions across the entire credit lifecycle.

We believe in turning complex data into clear direction. With NuScore, you’re not just making decisions—you’re making informed, intelligent ones that accelerate growth, reduce risk, and enhance customer experiences.

API-driven evaluations for real-time decisions

Tech stack with robust data security

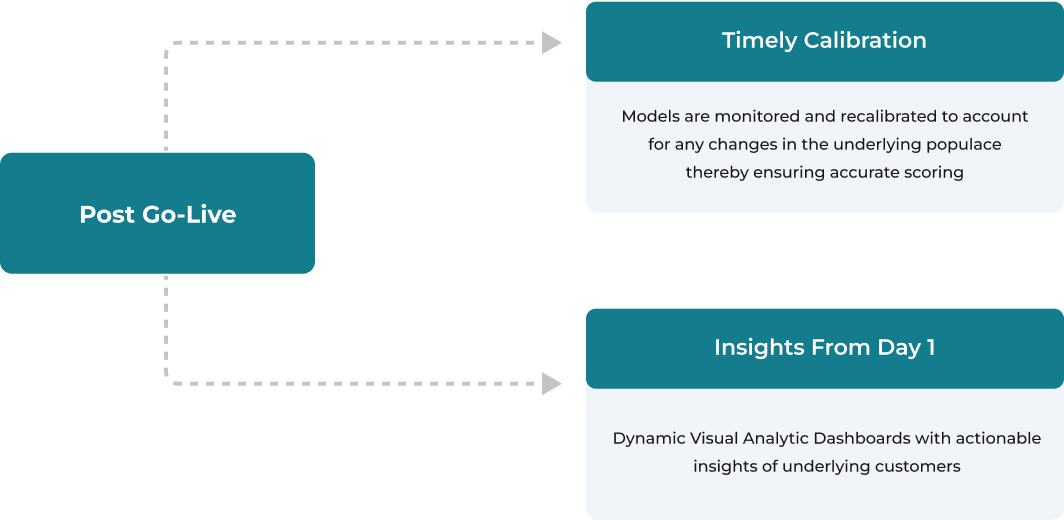

Models recalibrated for dynamic portfolios

Borrower behaviour insights for strategic growth

CREDIT

UNDERWRITING

REJECT

INFERENCE

ANALYTICS

PORTFOLIO

ANALYTICS

DASHBOARDS

EARLY

WARNING

SIGNALS

ML BASED SCORECARD FOR COLLECTIONS PROCESSES

CROSS-SELL AND

UPSIZE

OPPORTUNITY

IDENTIFICATION

Better

Rejection

Quality

Lower

Acquisition

Cost

NPA

Reduction

Higher

Approval

Rate

*As per our internal estimates

We prioritize data security and compliance by working exclusively with anonymized data, ensuring sensitive customer information remains protected.

Our machine learning models are trained on your data, aligning risk assessments with your specific customers, lending policies, and market conditions.

We continuously monitor model performance throughout its lifecycle, detecting shifts and recalibrating to ensure sustained accuracy.

We collaborate closely with your policy, risk, credit, and product teams to ensure that machine learning-driven decisions fit your strategy and comply with regulations.

With extensive experience in India’s lending market, we apply proven assessment methods for smarter, real-world credit decisions.

Our model governance framework is independently validated to ensure rigor, transparency, and alignment with industry standards.