nPOS is a cloud-based API-enabled market infrastructure platform, nPOS, to streamline the loan process for partnership lending/ co-lending by connecting banks and other financial institutions through a series of APIs, enabling swift data exchange and straight through processing of loans without manual interventions, completing the entire process within a few seconds.

We have developed a comprehensive cloud-based API-enabled market infrastructure platform, nPOS, to streamline the loan process for partnership lending/ co-lending by connecting banks and other financial institutions through a series of APIs, enabling swift data exchange and straight through processing of loans without manual interventions, completing the entire process within a few seconds.

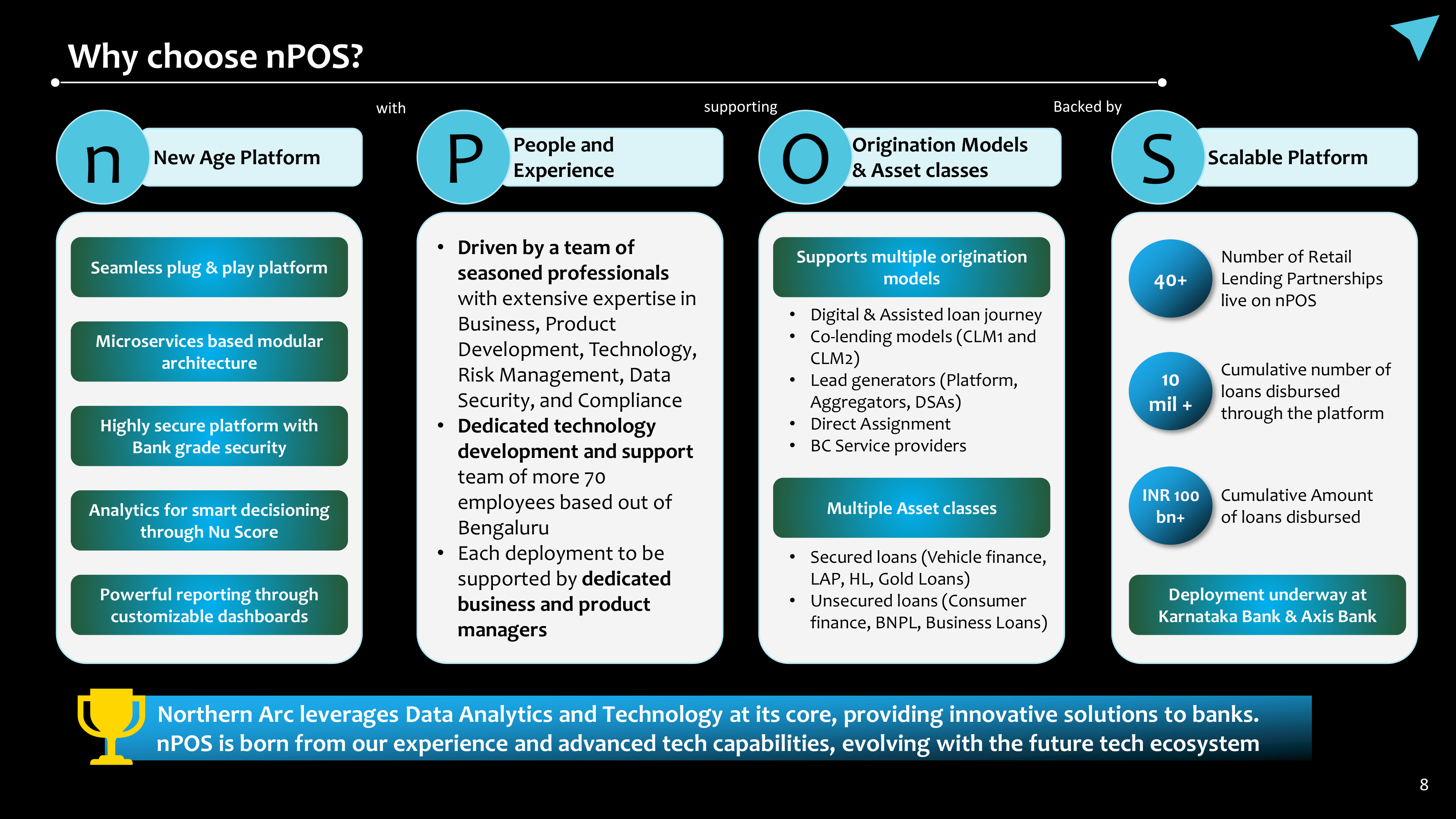

From microfinance to MSME loans, mortgage loans to consumer durable loans, the unique protocols of nPOS accommodate all types of our Direct to Customer loans across multiple sectors and assist banks and financial institutions in building their retail portfolio. In Fiscal 2024, the number of active partners and value of transactions on nPOS was 21 and ₹59,890.64 million, respectively.

In Fiscal 2023, nPOS received the ‘SOC 2 Type II’ attestation from the American Institute of Certified Public Accountants and ‘SOC 1 Type II’ audit for adherence to the International Auditing and Assurance Standards Board’s International Standard of Assurance Engagement 3402 standards.

As a conclusion: “Our next-generation lending platform is exclusively tailored for the retail segment that revolutionizes the lending/borrowing experience by digitizing the entire loan lifecycle with integrations for the originator, investor, facilitator platforms, and the India Stack ecosystem for co-lending arrangements. With superfast processing, the ability to handle very large pools, personalized offerings, and an intuitive user interface it greatly simplifies the interactions between borrowers, originators, and lenders (banks and financial institutions)”.