India’s focus on financial inclusion is increasing; however, a large section of the population is still unbanked. Financial exclusion is widely prevalent in countries, such as India, due to poverty and low income, financial illiteracy, high transaction costs, and lack of infrastructure (primarily information technology). Consequently, a significant proportion of the population still lacks access to formal banking facilities.

Northern Arc Capital, a leading player among India’s diversified NBFCs , set up primarily with the mission of catering to the diverse credit requirements to underserved households and businesses. Since 2009, when we entered the financial inclusion space, we have enabled financing for Originator Partners who have impacted over 54.21 million lives across India, of which more than 42 million were women. As of March 31, 2020, through our Originator Partners, we had credit exposure, directly or indirectly, spread across 657 districts in 28 states and seven union territories. We have cumulatively raised over Rs. 950.00 billion in funds for our clients, including funding from our own balance sheet and funding from a large number of Investor Partners, most of whom are repeat users of our platform. We have executed over 900 structured finance transactions, obtained over Rs. 28.00 billion in investor commitments across nine high performing funds and gathered over 22 million data points on customer repayment behaviour.

Using our customized credit-underwriting approach and tailored product suite that aids in the deployment of capital, we continue to build a diversified business with multiple offerings.

A deep understanding of economics of businesses and sectors at the grassroot level combined with robust credit and risk underwriting has enabled our Company to diversify across sectors, geographies, borrower segments and products. Our quantitative analysis is based on our data lake of 22 million granular loans and pools evaluated and invested in by us over a decade. Our technology system, Nimbus connects with many Originator Partners over Application Programming Interface (API) and processes data and workflows.

Over 400 investors have invested in products structured and executed by Northern Arc or in the Alternate Investment Funds managed by Northern Arc Investment Managers. These include banks, asset management companies, insurance companies, DFIs, fund-of-funds, AIFs, microfinance investment vehicles, FPIs, global investment vehicles, family offices, private wealth managers, foundations and HNIs. We offer due-diligence capability, rigorous approach to underwriting, on-going monitoring/surveillance, skin-in-game/co-participation by us, and the execution efficiency that our platform provides.

The growth in the number of Originator Partners and Investor Partners also attracts new borrowers and lenders which creates positive network effects and a diversified platform. Originator Partners on the platform engage in repeat transactions because of access to deep pools of liquidity, wider classes of investors and the ability of the platform to meet their unique requirements.

We have demonstrated a track record of more than a decade in offering customized products for various users of our debt platform. Our Company has pioneered the introduction of multiple innovative products such as the first securitization of microfinance loans, first pooled multi-originator securitization transactions (“MOSEC®”), persistent securitization (“PERSEC®”) involving securitization of vehicle loans with a replenishing structure. Embedded in our product designing capability is an understanding of the diverse credit requirements of our retail borrowers, Originator Partners, and mid-market companies, the sectors that they operate in, as also the risk and return expectations of our Investor Partners.

Our product structuring and designing capabilities have earned us awards for the ‘Best Arranger of the Year’ consecutively in 2018 and 2019 and ‘Most Innovative Deal’ in 2019 by the Indian Securitization Foundation. Our knowledge in product designing and customization is further strengthened by Nimbus, which makes use of technology and our Company’s large data lake to offer curated opportunities to both Originator Partners and Investor Partners.

Further, we selectively assume skin-in-the-game in some of these products to enhance their credit rating and enable our Originator Partners and other businesses to raise debt from investors. The skin-in-the-game could be in the form of guarantees for a stated amount, co-investment, and credit enhancement in the form of investment in subordinate tranches of an instrument or unfunded second-loss credit enhancement.

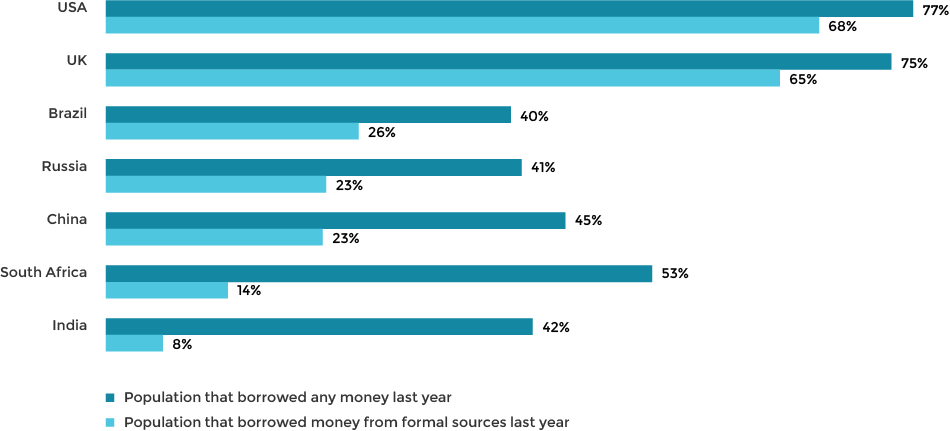

A very small proportion of Indian population is well served by the financial ecosystem with full access to a range of credit products. The promise of growth however lies in the urban mass, rural mass and rural emerging segments of India which are largely underbanked. The Global Findex report 2017 states that about

40 percent of Indians had accessed some form of credit during the year 2017. Of these, less than 10 percent had availed credit from formal sources of borrowing. All the remaining had availed credit semi-formally from family and friends and other sources. These underbanked segments form the core of Northern Arc core focus.

We work with specialized non-banks, differentiated banks and fin-tech players who cater to the unique needs of this segment. These non-bank players are expected to continue growing, driven by a deep understanding of customers, track record of product innovation, efficient delivery systems, and a differentiated value proposition.

By mining for opportunities, and applying innovative, data-backed solutions Northern Arc Capital’s social impact is substantial and growing.

By enabling partners operating in remote areas of India to increase their volumes and lower their cost of borrowing, to on-lend to low-income and financially excluded households and businesses, our activities are now benefitting over 54 million individuals.

By enabling partners operating in remote areas of India to increase their volumes and lower their cost of borrowing, to on-lend to low-income and financially excluded households and businesses, our activities are now benefitting over 54 million individuals. The company also helps its clients build better operating

and monitoring systems, as well as implement customer protection principles, thus improving the quality of products and services that end borrowers receive. Therefore, we just don’t deliver unique business opportunities, we also support them in becoming great investments.

Debt Capital raised since inception

in 28 states and 7 union territories

across 6 asset classes (Microfinance, MSME Finance, Vehicle Finance, Consumer Finance, Affordable Housing Finance, Agricultural Supply Chain Finance)