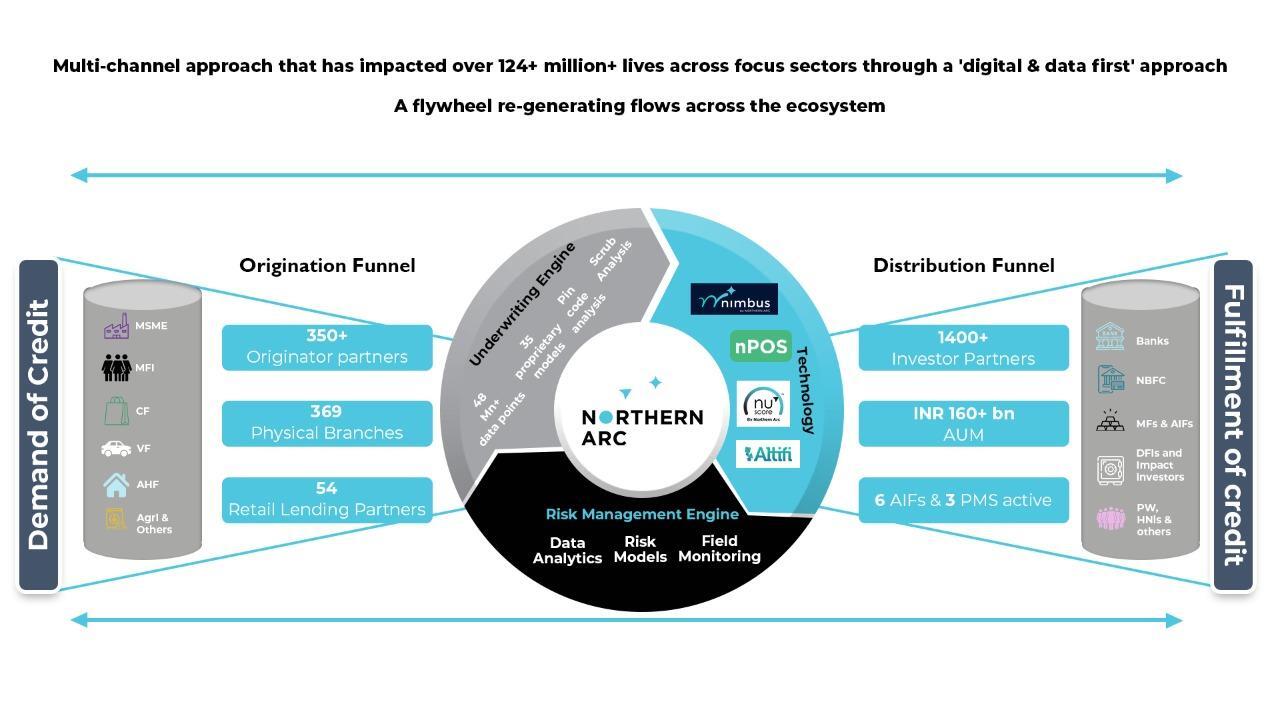

At Northern Arc, we identify Originator Partners through our lending channel based on a credit underwriting framework. This is designed to identify and nurture companies that are close to their customers and share the similar goal of catering to the credit requirements of the under-served segments, and who possess the ability to grow with access to debt. Most of our Originator Partners are initially relatively smaller in scale and typically have limited avenues of raising debt. This gives us the opportunity to build long-term relationships with first mover advantage and derive benefit from continued engagement as they scale up in their businesses and grow their credit requirements.

Notes: (1) Represents the cumulative number of Originator Partners onboarded since Fiscal 2009 as of 31 March 2024 (2) Number of branches that are operated for Direct to Customer lending as of March 31, 2024 (3) Represents Retail Lending Partners through whom loans are extended directly to Direct to Customer borrowers as of March 31, 2024 (4) Represents the cumulative number of investors with whom credit has been enabled through Placements business for Originator Partners and/or have invested across Northern Arc’s funds as of March 31, 2024 (5) AUM represents aggregate of loans and investments in debentures, securitized assets (including loans assigned), units of AIF funds, loans assigned by Northern Arc and guarantees outstanding as of March 31, 2024. (6) Number of live funds represents the number of AIF funds and PMS funds that are in existence or have outstanding investments as of March 31, 2024, Fund 2 has been considered as a live fund in Fiscal 2024, only due to the recoveries in progress from investees (7) Data as on March 31, 2024

We also partner with Retail Lending Partners to lend to Direct to Customer borrowers, who support in various functions such as loan origination, execution of loan documents, disbursements and collections. In addition to assuming on-balance sheet exposure through loans and investments, we cater to these differing credit requirements of our Originator Partners through our Placements channel. This includes structures such as securitization and direct assignment which involve investment in their retail pools, and arrange, syndicate and guarantee debt for fund raising from Investor Partners. We have built partnerships with Investor Partners across different asset classes. From banks to asset management companies, insurance firms, DFIs, fund-of-funds, AIFs, foreign portfolio investors, global investment vehicles, family offices, private wealth managers, foundations, and HNIs, we open avenues to invest in underserved households and businesses in India through our platform.

We offer Investor Partners with a comprehensive suite of services, such as due-diligence capability, customized approach to underwriting, on-going monitoring/ surveillance, skin-in-game/ co-participation by us, and the execution efficiency that our platform provides. Moreover, through our Fund Management channel, we deploy debt capital from our AIFs across select Originator Partners and other businesses.

Our technology products and data capabilities are the backbone of our ecosystem, which ensure the seamless interaction between Originator Partners, Retail Lending Partners as well as Investor Partners, facilitated through our platform, Nimbus, that enables end-to-end processing of debt transactions. To deepen our relationships with Originator Partners, we have developed a proprietary product, Nu Score, which is a tailored machine learning based scoring module designed to assist in the loan underwriting process and help them take effective credit decisions. Further, to enable technology-backed seamless co-lending process, we have developed nPOS, a fully integrated API based technology solution that seamlessly integrates with the systems of both Originator Partners (including Retail Lending Partners) and Investor Partners. In addition, AltiFi, our alternative retail debt investment platform, further enables us to capture a wider base of retail investors, who may subsequently graduate to investing in our funds.

This multi-channel offerings supported by proprietary technology and data capabilities, enables funding to the end-customer and aids our Originator Partners, Retail Lending Partners and Investor Partners as well as AltiFi investors in expanding their outreach and access new debt capital pools and investment opportunities. This synergy and seamless integration creates a ‘flywheel effect’, which gets accentuated with more transactions and incremental flow of data.