From our vantage point, we have the ability to straddle opportunities in credit, investment banking and fund management. We understand the needs of our investors as well as the needs of our clients. Through a combination of our capital, products and partnerships, we connect millions of borrowers to mainstream debt investors. Our rigorous credit underwriting approach and our in-depth understanding of capital markets allows us to offer efficient debt solutions for client partners and attractive risk-return opportunities for debt investors.

Our financing initiatives are aimed at Originator Partners, which include NBFCs (including NBFC-MFIs), HFCs and SFBs.

The market share of NBFCs in overall systemic credit has increased from 16% in Fiscal 2015 to 20% in Fiscal 2021, the reason for which is their ability to offer differentiated solutions to cater to the large unmet demand of various retail lending sectors. The aggregate size of NBFC loans in the sectors that we operate in is Rs. 12.7 trillion as of Fiscal 2021, which is expected to witness strong growth in the next few years due to favourable demographics, increase in consumer spending and business activity. As of September 30, 2020, our Originator Partners reported a cumulative AUM of over Rs. 2.80 trillion and as of March 31, 2021, they had borrowers in 657 districts spread across 28 states and seven union territories of India.

Our relationships with Originator Partners are typically long-term in nature. We offer products suited to the specific life cycle and credit needs of our Originator Partners. Out of the total of 228 Originator Partners we have that are currently onboarded, 54.82% were relationships of more than three years and out of the total Originator Partners that we have worked with since inception,80.95% have involved repeat business.

We have dedicated origination teams for each of the focussed sectors in which we operate, each of which is responsible for originating relationships with potential Originator Partners and for working with Originator Partners to fulfil their financing needs. We identify potential Originator Partners in various ways including market research, participation in industry meets and seminars, networking with industry influencers, and organic enquiries received from newly set up Originator Partners.

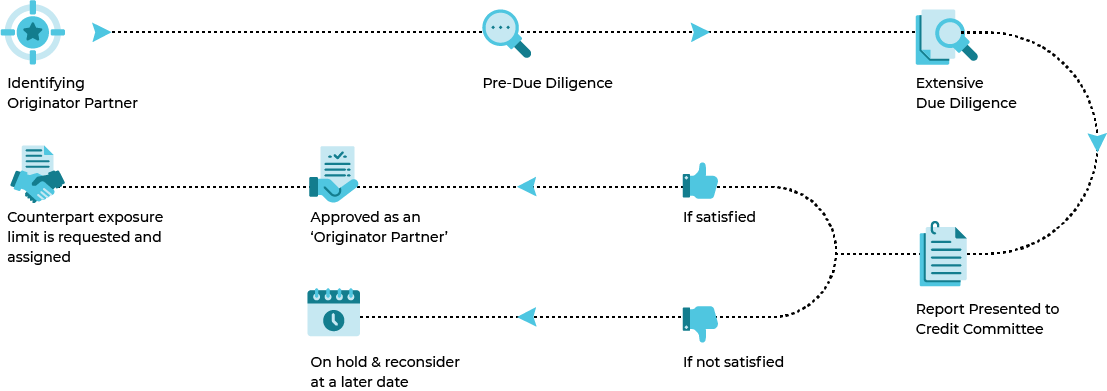

Upon identifying a potential Originator Partner, the origination teamconducts an initial pre-due diligence (“pre-DD”) review. If the potential Originator Partner fulfils our initial pre-DD criteria, an extensive due diligence (“DD”) process is undertaken to assess the client against our underwriting guidelines for the relevant sector. This involves obtaining and analysing operational and financial information and business plans, review of governance structures, interviews with the management, operating team and promoters or equity investors of the potential Originator Partner, site visits, market checks, etc., based on which a detailed DD report is prepared. The DD report is presented to our Credit Committee (“CC”) by the origination team which may seek additional information as needed. If the CC is satisfied with the entity assessment and the business potential with the entity, it approves the entity which is then onboarded as an Origination Partner, and a counterparty exposure limit is then requested and assigned. Alternatively, the CC may decide not to onboard the entity or to keep it on hold and reconsider at a later date if there is an adequate improvement in the financial or non-financial parameters. Since 2009, we have conducted pre-DD on 483 financial institutions, of which DD was undertaken on 295, and 228 were approved and on-boarded as Originator Partners.In Fiscal 2021, we have commenced the digital onboarding of potential originator partners through Nimbus. This allows our partners to share data as may be required by us for our pre-DD or DD processes, respond to queries raised by us and also monitor the status of onboarding from time to time.

Once an Originator Partner is on-boarded, the relationship managers maintain regular contact and understand their financing requirements based on their business needs. Further, our relationship teams engage with the Originator Partners to understand their growth plans, the planned equity and debt raise and identify the debt requirement that our Company can facilitate. We ensure that each incremental exposure by our Company (whether through loans, investments, guarantees or other credit enhancements) is within the limit approved for such Originator Partner, and is individually considered by the CC and may be approved or rejected based on the specific evaluation undertaken at that point. Based on periodic review and changes in the financial and non-financial parameters as also the business plans of the client, the partner limit may be revised upwards or downwards.